NEWS CENTER

Specially developed and developed high-end polyoxymethylene (POM) / long-fiber materials (PP.PA.TPU, etc.) in automobiles, electronic appliances, fasteners, sanitary, military, aerospace, marine, office supplies, agricultural irrigation, electronic appliances, etc.

A trillion dollars worth of tax cuts! China supports the development of plastics and chemical enterprises

- Categories:Company news

- Author:

- Origin:

- Time of issue:2018-12-13 13:16

- Views:

(Summary description)The executive meeting of the State Council held on October 8 determined that measures to improve the export tax rebate policy and speed up the...

A trillion dollars worth of tax cuts! China supports the development of plastics and chemical enterprises

(Summary description)The executive meeting of the State Council held on October 8 determined that measures to improve the export tax rebate policy and speed up the...

- Categories:Company news

- Author:

- Origin:

- Time of issue:2018-12-13 13:16

- Views:

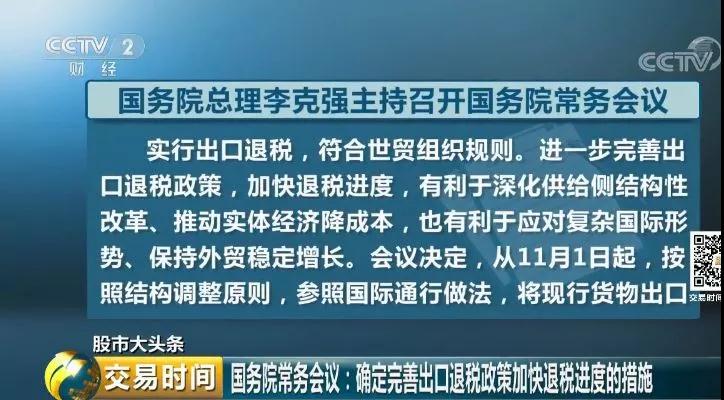

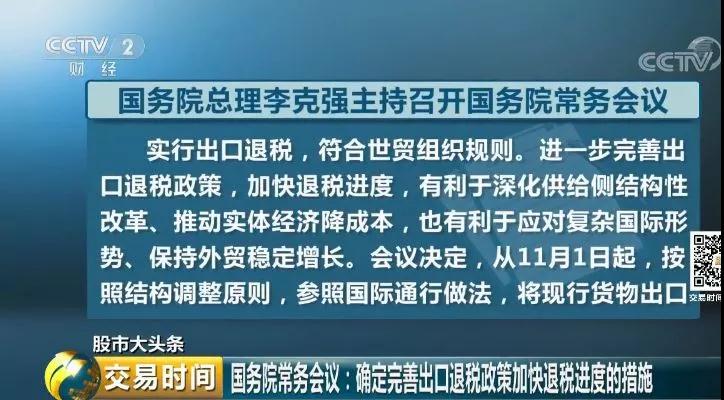

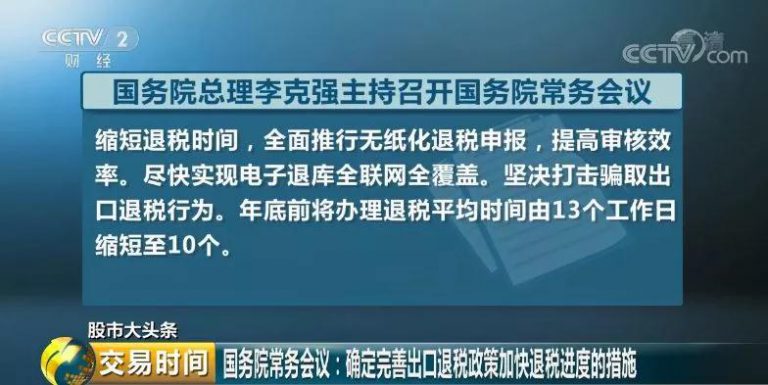

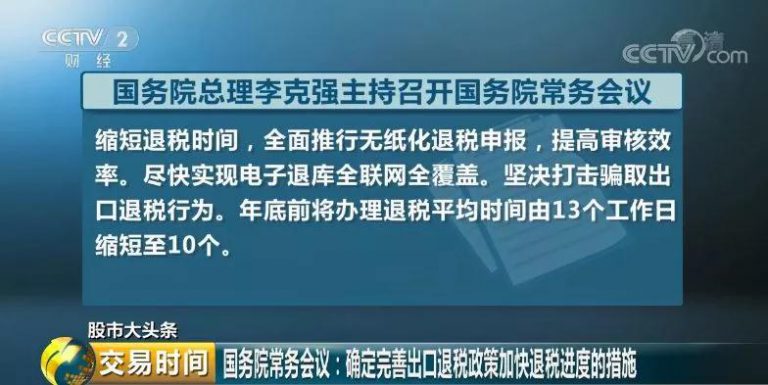

The executive meeting of the State Council held on October 8 determined that measures to improve the export tax rebate policy and speed up the tax rebate process will reduce the burden on enterprises and maintain steady growth in foreign trade.

At a regular press conference on October 10, the Ministry of Foreign Affairs stated that if the United States will levy taxes on all Chinese goods, China may reduce taxes substantially: the value-added tax will be reduced by 3% and corporate income tax by 2%.

Chemical products dominate in Sino-US trade war

Recalling several rounds of the Sino-US trade war, chemical products have always occupied an important position on the sanctions lists of both parties. After the first round of taxation in the United States, high-end manufacturing has become the main target of the second round of taxation, including chemicals, plastic products and metal products.

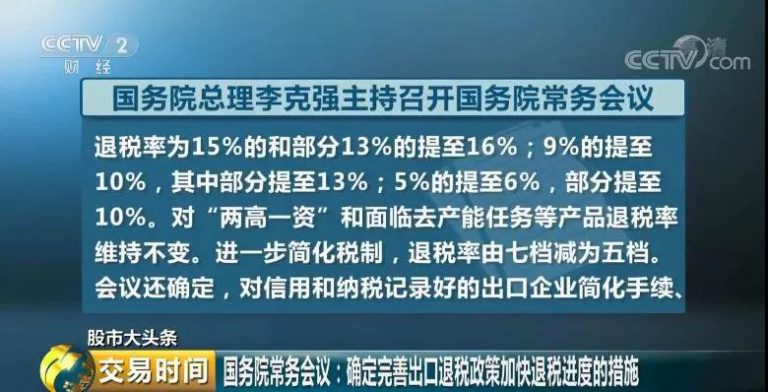

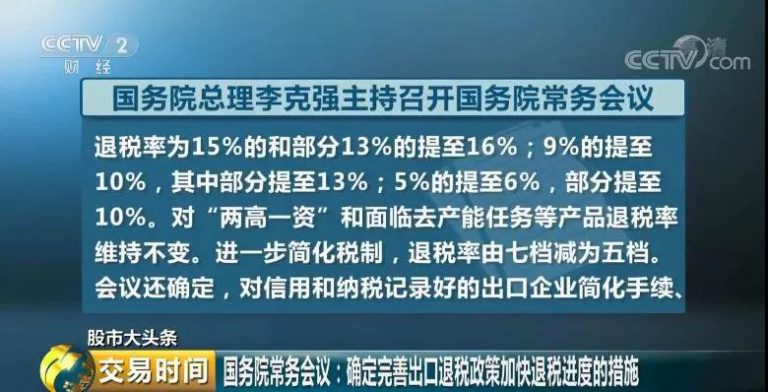

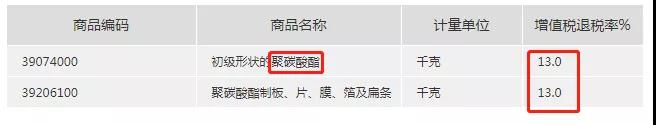

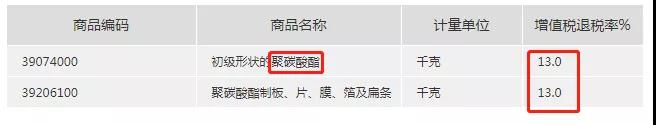

From November 1, the tax rebate rate will be raised to 16%, simplifying the tax system

From November 1, according to the principle of structural adjustment, referring to international common practice, the current export tax rebate rate for goods is 15% and part of 13% is raised to 16%; 9% is raised to 10%, part of which is raised to 13 %; 5% is raised to 6%, partly to 10%. The tax rebate rate for products such as "two highs and one capital" and facing the task of capacity reduction remains unchanged. To further simplify the tax system, the tax refund rate was reduced from seven to five.

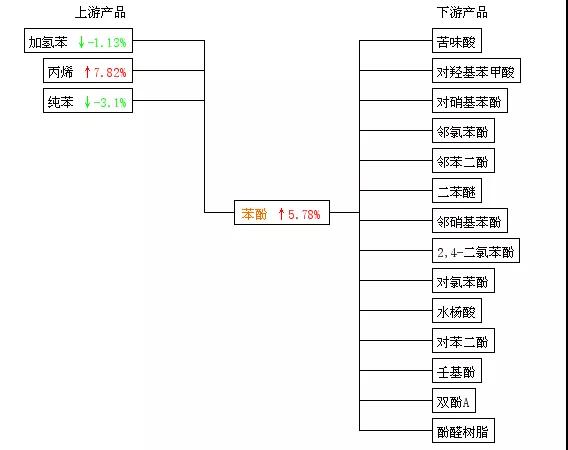

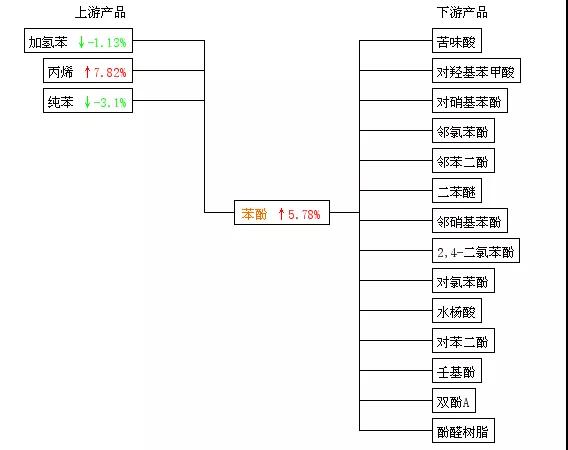

Phenol tax rebate rate increased to 9%, resin industry pressure eased

At the beginning of August, 5207 tax items originating in the United States amounted to about US $ 60 billion, with additional tariffs ranging from 25%, 20%, 10%, and 5%. Among the goods subject to tariffs this time, phenol will be subject to a 25% tariff, putting pressure on the industry.

In the recent "Notice on Increasing the Export Tax Rebate Rate of Products such as Electromechanical Culture", which involves the primary form of phenolic resin industry, the tax rebate rate before adjustment is 5%, and the tax rebate rate after adjustment is 9%, an increase of 4% Conducive to the export volume of phenolic resin will also directly increase the purchase volume of phenolic resin products for phenol, which invisibly forms a favorable support for phenol.

The price of pure benzene has risen by about 10%. As another important raw material for phenol, the price of propylene has reached a new high this year. At present, the price of polypropylene, a downstream product of propylene, has risen, and the operating rate of manufacturers has been greatly improved under the profit drive, which has increased the demand for propylene, thereby driving the price to rise. The market price of propylene has increased from 8,000 yuan / ton to 9,400 yuan / ton. The price of pure benzene and propylene rose sharply, supporting the high price of phenol.

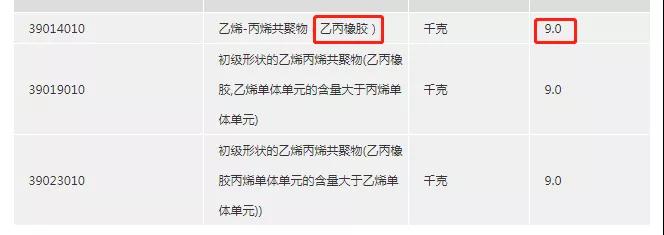

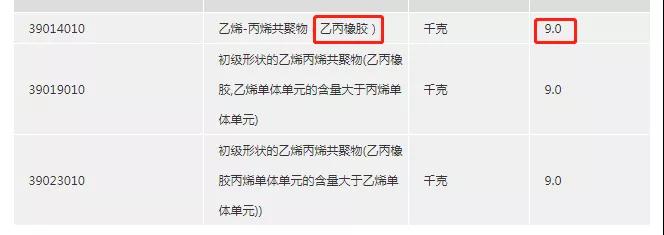

Benefit table of other chemical raw materials:

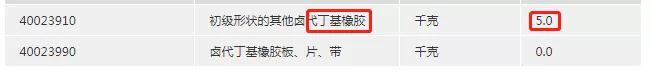

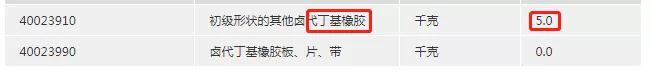

9% increased to 10%, and some of them increased to 13%:

From 5% to 6%, partly to 10%:

Larger tax cuts will be introduced to help business development

Minister of Finance Liu Kun said recently that under the role of active fiscal policy, tax cuts and fee reductions will be further increased this year. In addition to the policy of tax reduction and fee reduction of 1.1 trillion yuan for the whole year determined at the beginning of the year, a series of measures to promote the development of the real economy and support technological innovation have been introduced. This means that a larger tax cut may come, which indirectly indicates that China's cost reduction measures may continue to increase.

Scan the QR code to read on your phone

Page Copyright - Jiangsu Taiyi Plastic Technology Co., Ltd. 苏ICP备2020070769号-1 Powered by www.300.cn